Know Your Customer (KYC)

- Know Your Customer (KYC) is one time mandatory process to invest in mutual funds. Securities and Exchange Board of India (SEBI) has made KYC compliance mandatory for mutual fund investments.

- KYC norms are meant to prevent money laundering and corrupt practices. KYC process enable to identify customers on financial dealings.

- KYC norms are uniform across SEBI regulated intermediaries. KYC norms are investor friendly as it eliminates duplication process.

- Online KYC process is executed through video In-Person Verification (IPV). KYC process can be done offline or online IPV.

- KYC registration is centralized process through KYC Registration Agencies (KRAs) registered with SEBI. This can be done by giving a single request to the agency through any registered intermediary.

- Mutual fund KYC can be updated using KYC Details Change Form. Change in KYC details arise when there is change in Name, Address and Residential Status. KYC details cannot be changed online.

- Investor has to be KYC compliant to transact in mutual funds. PAN card is required to initiate KYC process. Records of mutual fund KYC and KYC in banks are maintained distinctively as of now.

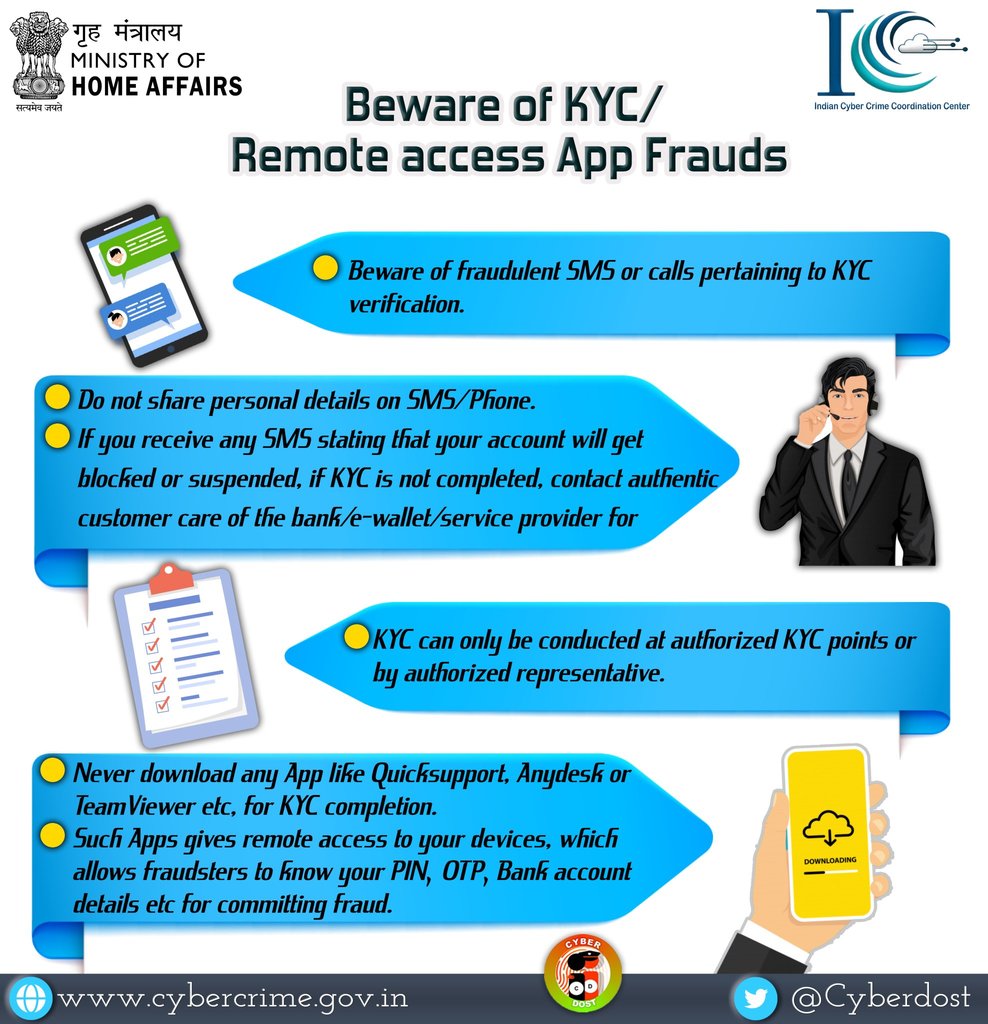

Beware of KYC / Remote Access App Frauds

Source: PIB