Enjoy Retirement!

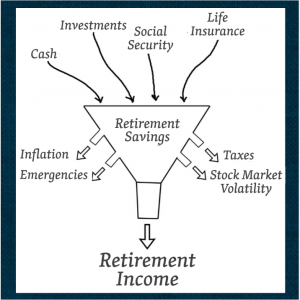

Retirement planning calls for regular savings for investing in different asset classes during accumulation phase when income is generated.

The asset allocation strategy and portfolio re-balancing periodically ensures distribution of wealth in his / her post retirement phase.

Retirement planning is thus determining retirement income goals and the process to achieve it – identifying income source, estimated expenses, savings and investments and managing it in line with risk adjusted return.

Recommended Investment Avenues for Senior Citizens

Senior Citizens Savings Scheme (SCSS) is a Government-backed savings instrument offered to Indian residents aged over 60 years. It is the highest interest rate among the various small savings schemes in India. Interest on SCSS is fully taxable. Investments made in a Senior Citizen Savings Scheme account qualify for income tax deduction benefit under Section 80C of the Income Tax Act, 1961.

- For senior citizens aged 60 years and above

- PMVVY is exempted from GST

- Loan upto 75% after 3 policy years

- Policy term is 10 years

- Investment limit is Rs. 15 lakhs per senior citizen